Lien waivers are probably the single most misunderstood payment document there is in construction. Which is kind of funny, because lien waivers are everywhere in this industry. Still, confusion about these crucial construction payment documents remains widespread. For instance, did you know:

Waiver notarization is usually not required. There are only three states where waivers must be notarized – Texas, Wyoming, and Mississippi. Notarizing waivers in any other state besides these three is a waste of time. Some that persist with notarization claim CYA, but it doesn’t really cover anything.

- GCs/Payors need to collect waivers from everyone on the project. This one is a huge misperception among many of the GCs and construction managers that we talk to. To really mitigate your lien risk, you need lien waivers from everyone working on the project, not just the parties that you contracted with directly and whom you likely have proof of payment. In short, if they have lien rights, you need a signed lien waiver from them. Otherwise, you may be at risk for a lien claim, and potentially, a double payment.

If this isn’t new information, then congratulations, you’re a step ahead of about 98% of your industry peers. If this is news to you don’t worry you’re not alone.

Construction Payments are Challenging

There are many things that make construction different from other industries, and those differences extend to the realm of payments. The most unique feature of construction payment may just be that payments are in effect guaranteed by mechanics lien rights which have been a part of the domestic industry since the 1780s. Anyone furnishing materials, labor, or services to a construction project may be entitled to file a mechanics lien or bond claim as a last resort to secure payment if payment is otherwise not forthcoming. Naturally, the project stakeholders receiving payments are highly motivated to retain their lien rights until they have actually received payment.

On the other hand, the stakeholders making payments (particularly owners, lenders, GCs, and also subcontractors) are equally motivated to avoid lien claims that can delay or even prohibit a project from being successfully completed. Throughout history, these motivations have been positioned as competing, and this has resulted in turning an otherwise normal business function into a needlessly adversarial exercise that ends up being very stressful for everyone involved.

Enter the lien waiver which was invented to help manage this difficult situation: the construction industry’s receipt.

Simply put, a lien waiver functions as a receipt. Lien waivers provide evidence that a payment was made (or promised). In consideration of that payment or promise of payment, a party waives their rights to lien for a corresponding amount. However, while the lien waiver concept in theory is quite simple, actually using lien waivers on a project correctly can be very complicated and challenging for all involved.

Breaking Lien Waivers Down

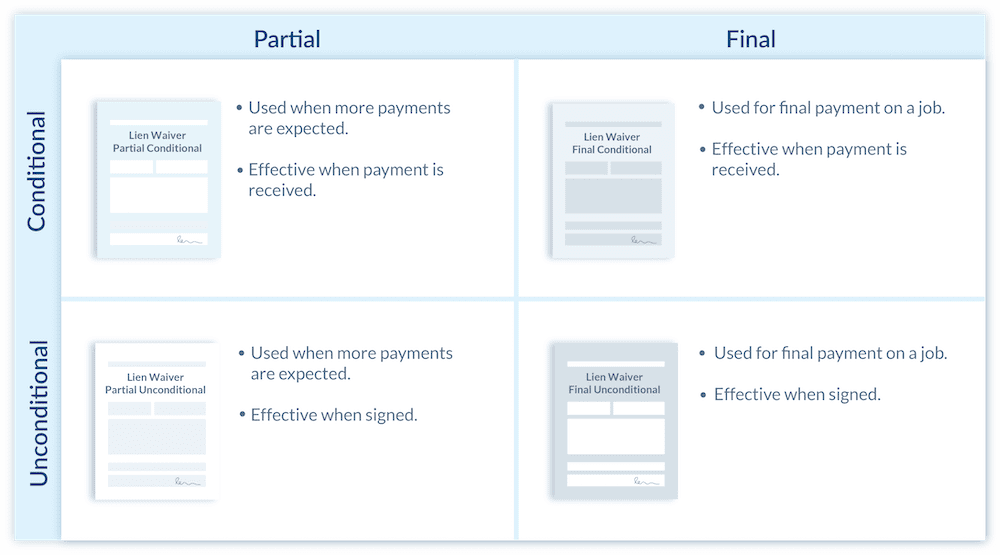

To begin with, there isn’t just one type of waiver, there are actually four different types of waivers, and matching the correct waiver type to the specific payment situation at hand is critical.

The most important thing here is the difference between conditional and unconditional waivers. Taking the latter first, unconditional waivers should only be used when payment has been made and/or received. Conditional waivers may be used prior to making and/or receiving payment, since these waivers are effective only when payment is made.

But let’s take a second to address a fundamental question: should conditional waivers be used or unconditional waivers? The truth is that conditional waivers are good for everyone, both for the parties making payments and the parties receiving payments. With a conditional waiver, the paying party has the assurance that they won’t be subjected to a double payment (and also, to a lien claim itself), and the party receiving payment remains in a protected position with their lien rights intact until they actually get paid.

In short, with conditional waivers, everybody wins.

Some States Have a Required Waiver Form

The other major aspect of lien waivers concerns the actual waiver form itself. That’s because in 12 states the actual waiver form used is mandated by that state’s lien law. The states are Arizona, California, Florida, Georgia, Massachusetts, Michigan, Missouri, Nevada, Utah, Mississippi, Texas and Wyoming.

For the other 38 states, lien waiver forms used are all over the place, and that can present a few problems. For one thing, not having a specific requirement creates a lot of confusion in the market — people just don’t know which form to use and when. Also, because there are no restrictions limiting the waiver language used in the actual forms in these states, it’s not uncommon to find all sorts of strange clauses in the waivers that are exchanged on construction projects in these 38 states every single day. However, a lien waiver should be used for one purpose only, and any attempt to try to use the waiver document as a tool to exert more leverage should be avoided.

One final note: be careful not to get confused by all of the different waiver terminology that you may encounter. This is especially problematic when people confuse lien waivers with lien releases (also known as a lien cancellation). These two documents are entirely different and often confused. Click on the link for some tips on how to keep them straight.

Lien Waivers – Everything You Need to Know

Lien waivers are a crucial part of a successful project’s paperwork. These documents are completed, signed, and exchanged thousands of times each day on projects across the United States. However, this doesn’t change the fact that, when it comes to waivers, many in the industry are doing it wrong.

To read more about lien waivers download a free copy of The Ultimate Guide to Lien Waivers. For your one-page guide click here.

Levelset and Procore’s recent integration allows you to minimize your lien risk with an easy and effective waiver process, while enhancing the experience of your project stakeholders. The integration links projects between Levelset and Procore. Any notices or completed waivers you receive in Levelset will be instantly sent to the project’s document library in Procore. To learn more click here.

Lien waivers are very much necessary for the construction workers. Thanks for sharing such a great information.