In an ever-changing market, civil and infrastructure construction continues to build with gusto. To gain insight into the current state of civil and infrastructure in the U.S. and Canada, Procore and AGC teamed up with Illuminas to survey construction professionals who work in this sector. This report based on their responses sheds light on market growth and government investment, the impact of self-perform work and data maturity on project performance, workforce challenges and solutions, insights around builder involvement in preconstruction, project delivery methods in use, and more.

Read on to discover top-of-mind findings from this civil and infrastructure report.

An expanding market driven by generational investment in infrastructure.

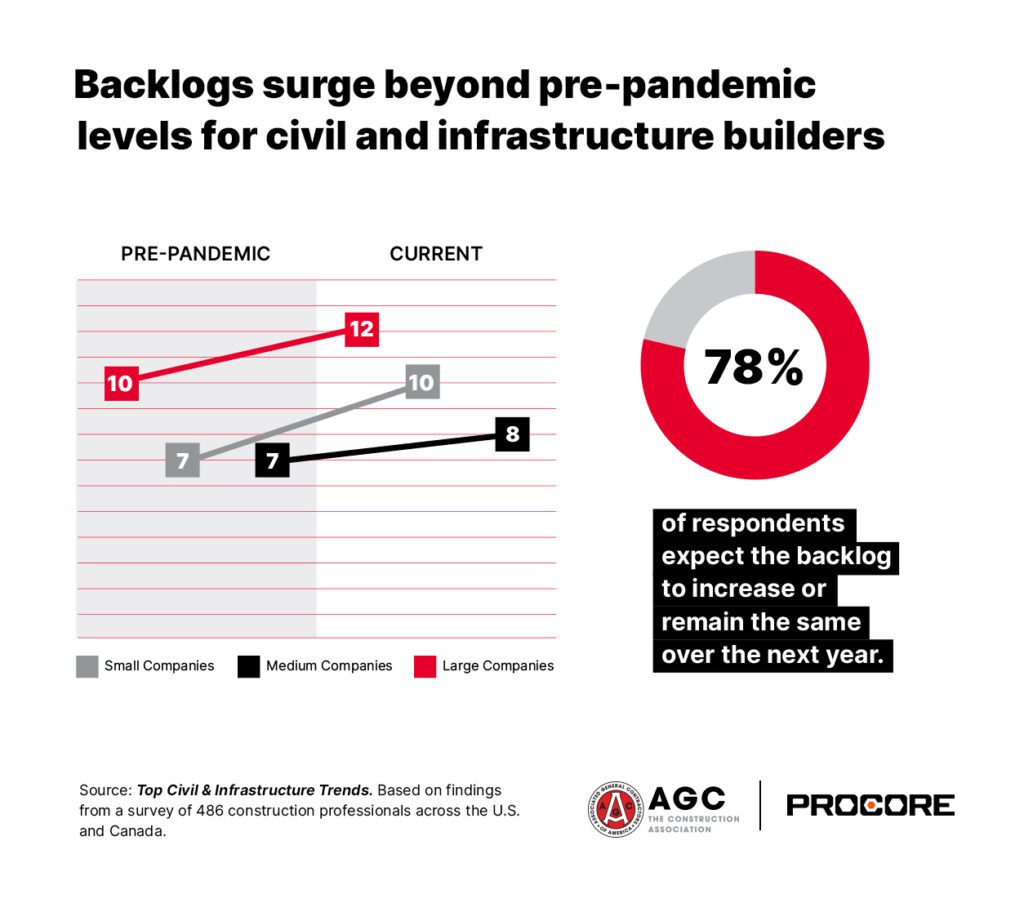

Civil and infrastructure’s expansion is surging, with respondents citing a 25% increase in backlogs since the pandemic. The growth of the sector, spurred by once-in-a generation government investment in the U.S. and Canada, reinforces the critical nature of these builders’ work in shaping our cities and communities. Government legislation is a key driver when it comes to this growth, supporting 38% of respondents’ projects. Not only does this underpin the importance of civil and infrastructure work, but this government investment will also create a plentitude of jobs across North America, further bolstering economic growth.

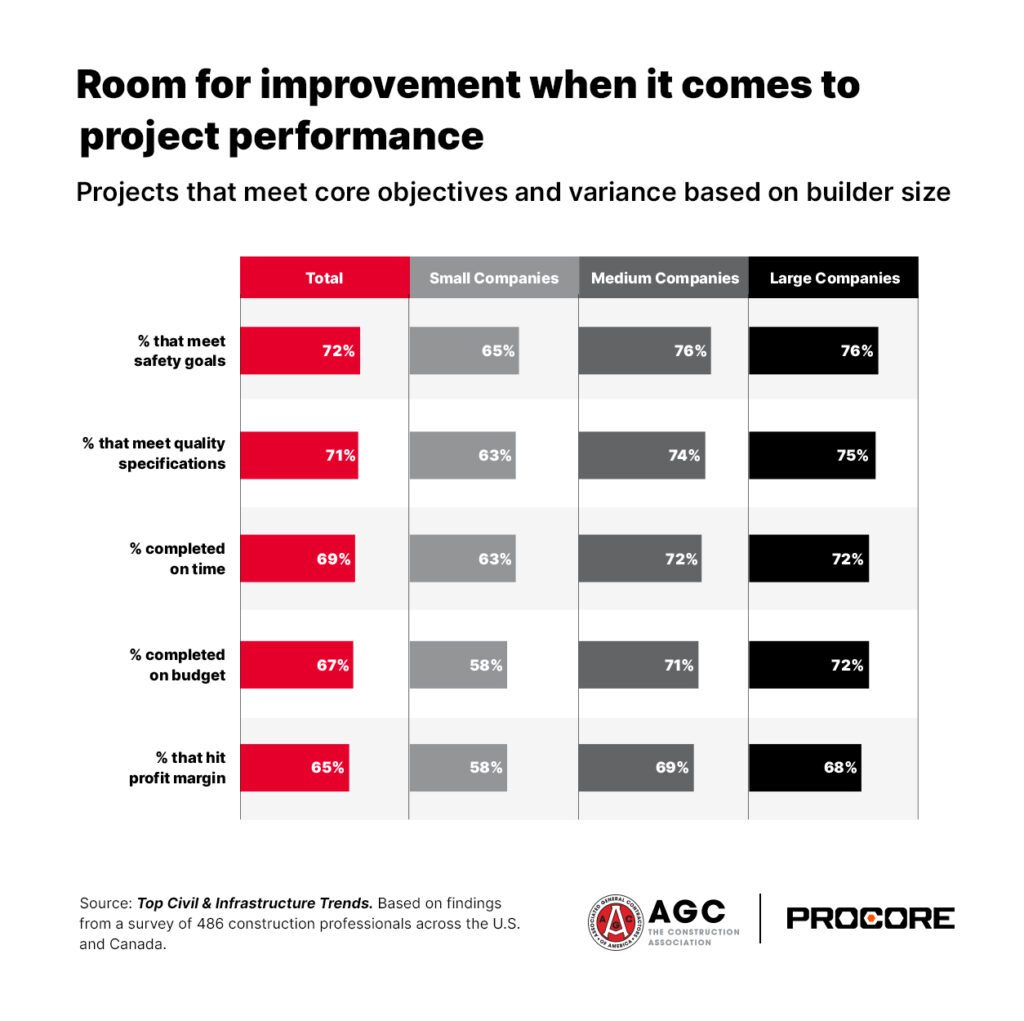

There’s a need to reduce performance gaps on projects.

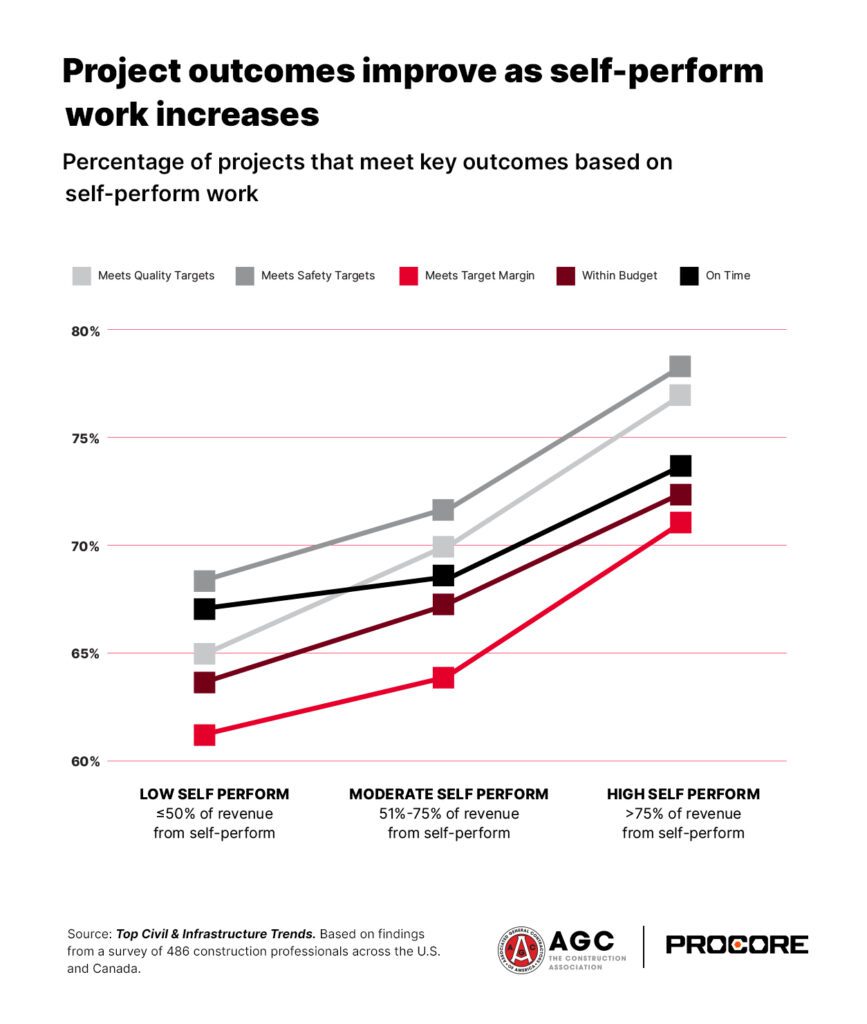

Working on a wide variety of project types and with increased backlogs, it’s more important than ever to achieve project outcomes. Unfortunately, about a third of projects fail to meet goals. Self-perform work and data maturity both have a big role to play when it comes to helping builders achieve these outcomes, as does early involvement and collaboration during preconstruction. It’s no surprise that 38% of respondents report being involved in the project at the capital planning or conceptual design phases with two-thirds involved during some stage of the design. This dynamic is leading to an increase in collaboration and risk distribution within the industry.

Workforce challenges substantially impact project success in a high self-performing market.

Successful project outcomes hinge on having the right talent especially in a high self-performing segment such as civil and infrastructure. It’s no wonder that 60% of top challenges that impact project success are labor specific, according to respondents. Upskilling current team members and discovering innovative recruitment or retention strategies are top of mind as organizations navigate the labor shortage. Further, 49% of respondents are investing in construction software in response to workforce scarcity. Software can not only help heavy civil builders make the most of their current labor, but can also help position a company as an attractive place to work for tech-savvy young talent.

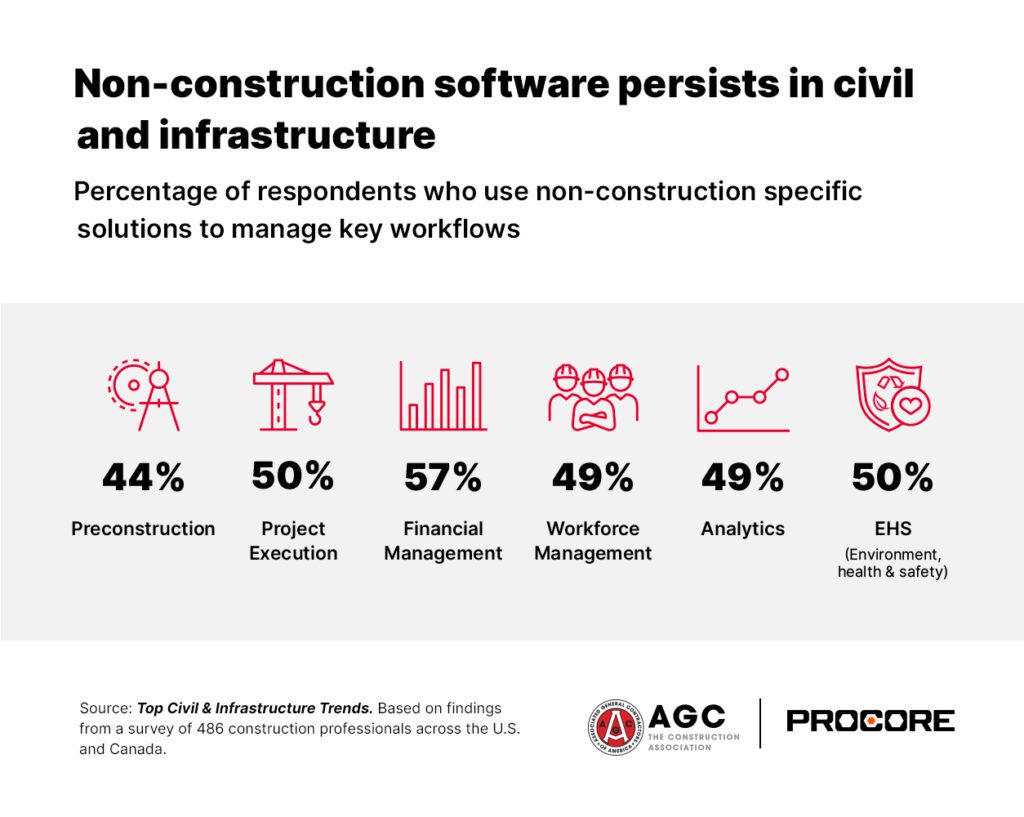

Non-construction-specific workflows and untapped data lead to inefficiencies.

While many organizations are using software to better their business, much of this technology isn’t built for construction. On average across categories, 50% of civil and infrastructure builders use non-construction-specific technology. Investment in technology not made for the industry can result in reduced capabilities, decreased transparencies and increased silos across the business as organizations try to make solutions work for them, rather than vice versa. Not using the right software also means that companies are struggling to access and leverage vital project information, with only 24% of builders reporting that they’re getting the full benefit from their data.

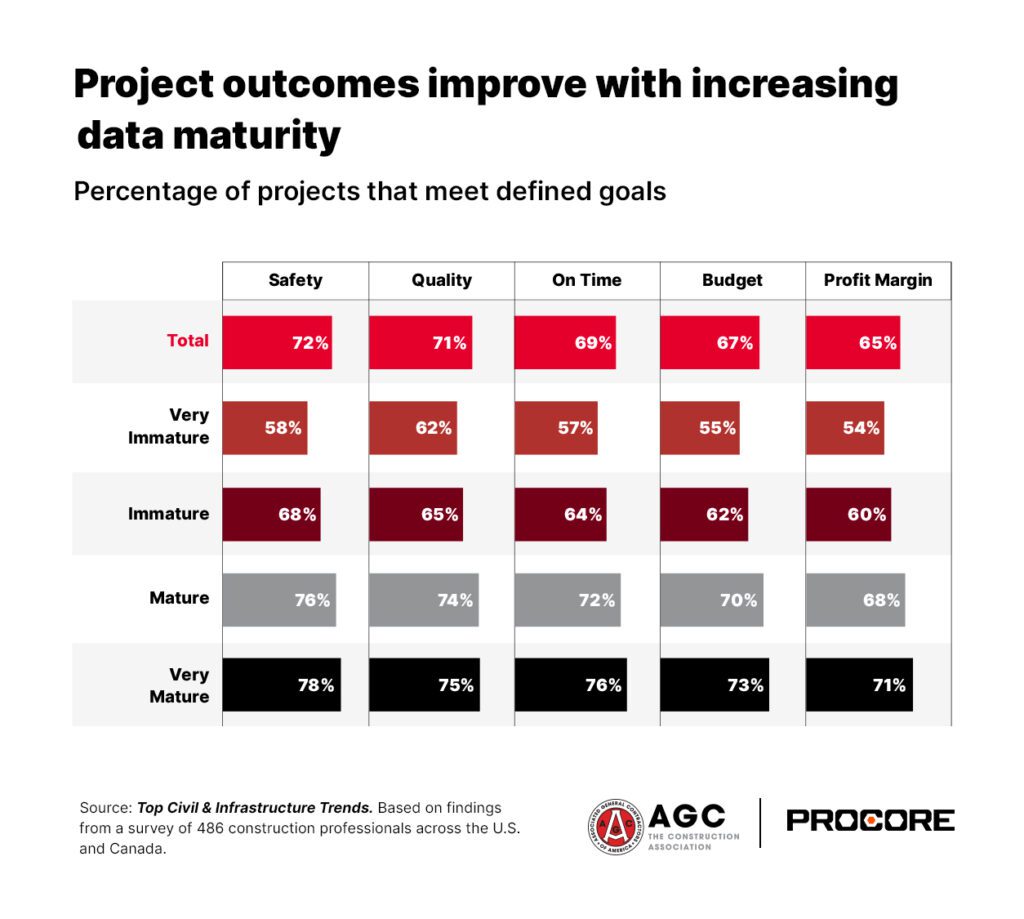

Self-perform work and data maturity key to running a better civil and infrastructure business.

Successful civil and infrastructure companies are also those who are data mature. By investing in their people and technology, organizations can enjoy heightened levels of data maturity to the point that data becomes a competitive advantage for the company. Accessible, accurate data is a key differentiator for organizations who are keen to make data-driven decisions across the business. Data-mature companies are more likely to meet project goals around quality, safety, budget, schedule and profitability.

For increased control around project outcomes, it seems self-perform is the optimal business model for civil and infrastructure projects. With high costs of labor, equipment and materials, organizations who self-perform can bring efficiency and productivity into more direct oversight. High self-perform companies bring more value to preconstruction by providing their valuable, specialized knowledge early in the process.

Leave a Reply