New Procore Research: Australian construction sector links technology to improved risk management, cash flow and insights needed for growth

Tech commitment in the spotlight as solvency risks and skills shortages remain major challenges

SYDNEY, Australia June 1, 2023 —

Procore Technologies Inc., a leading global provider of construction management software, today released the fourth iteration of its annual benchmark report, How We Build Now - Technology and Industry Trends Connecting ANZ Construction in 2023.

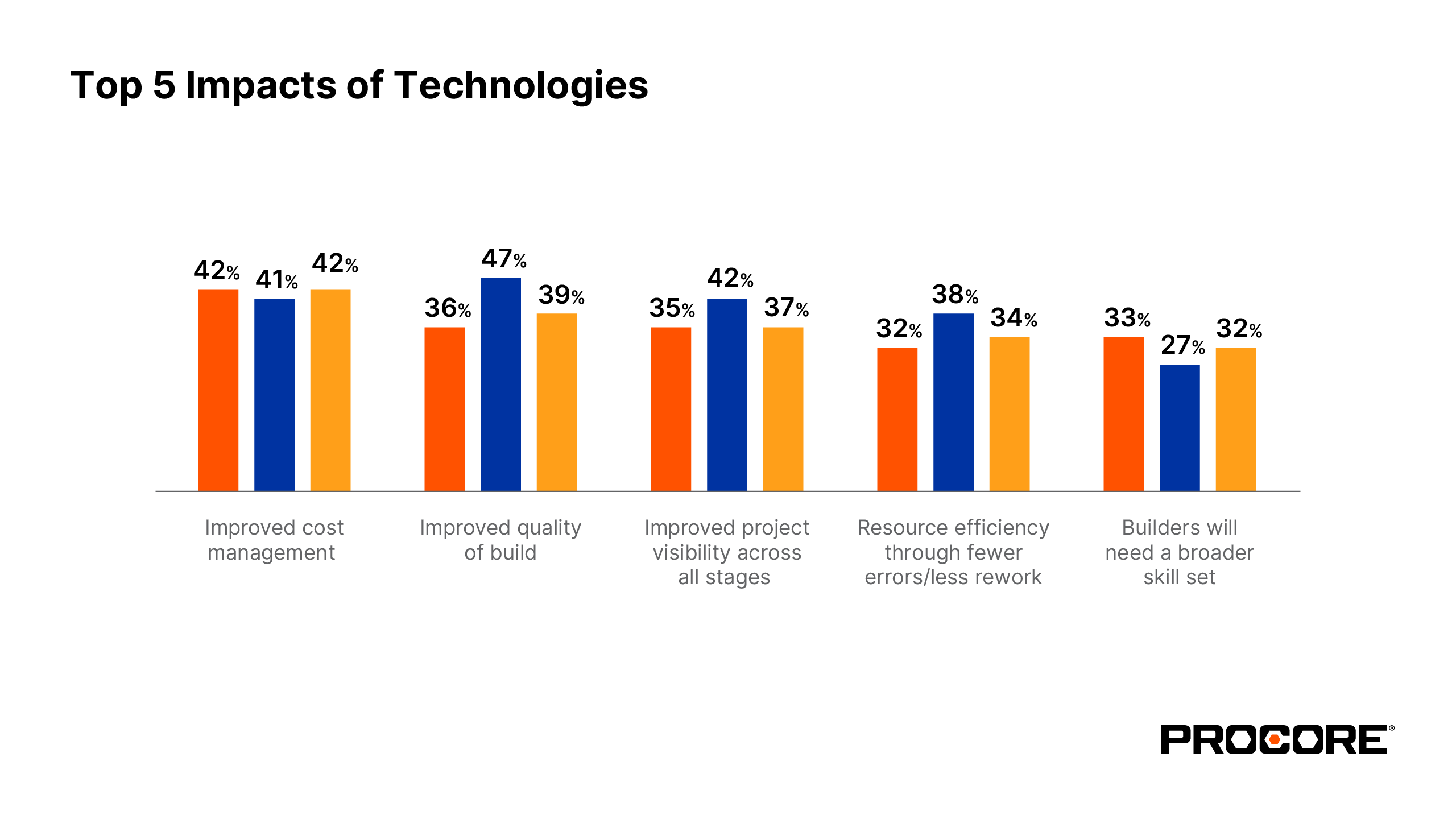

Covering market sentiment, challenges, risks and plans for the future, the report reflects an industry facing one of the most pivotal points in its history. Underlying the volatility experienced by industry participants over the past 12 months is the acknowledgement that technology solutions are now delivering improvements – and will continue to play a more strategic, analytical and defensive role in the future.

“How We Build Now highlights the challenges and opportunities the construction sector continues to face. Interestingly, some respondents indicated they would cut some of the technology in their business in the spirit of cost cutting. While it is important that technology delivers value to the business, I would encourage all decision makers to carefully assess what role that technology is playing day to day on projects, and understand the long term risk of removing it. The construction sector is still one of the least digitised industries in the world with a huge opportunity for margin improvement with the right technology. Now is not the time to be going backwards in the spirit of cost cutting.” outlined Tom Karemacher, head of region, APAC at Procore.

How We Build Now Insights:

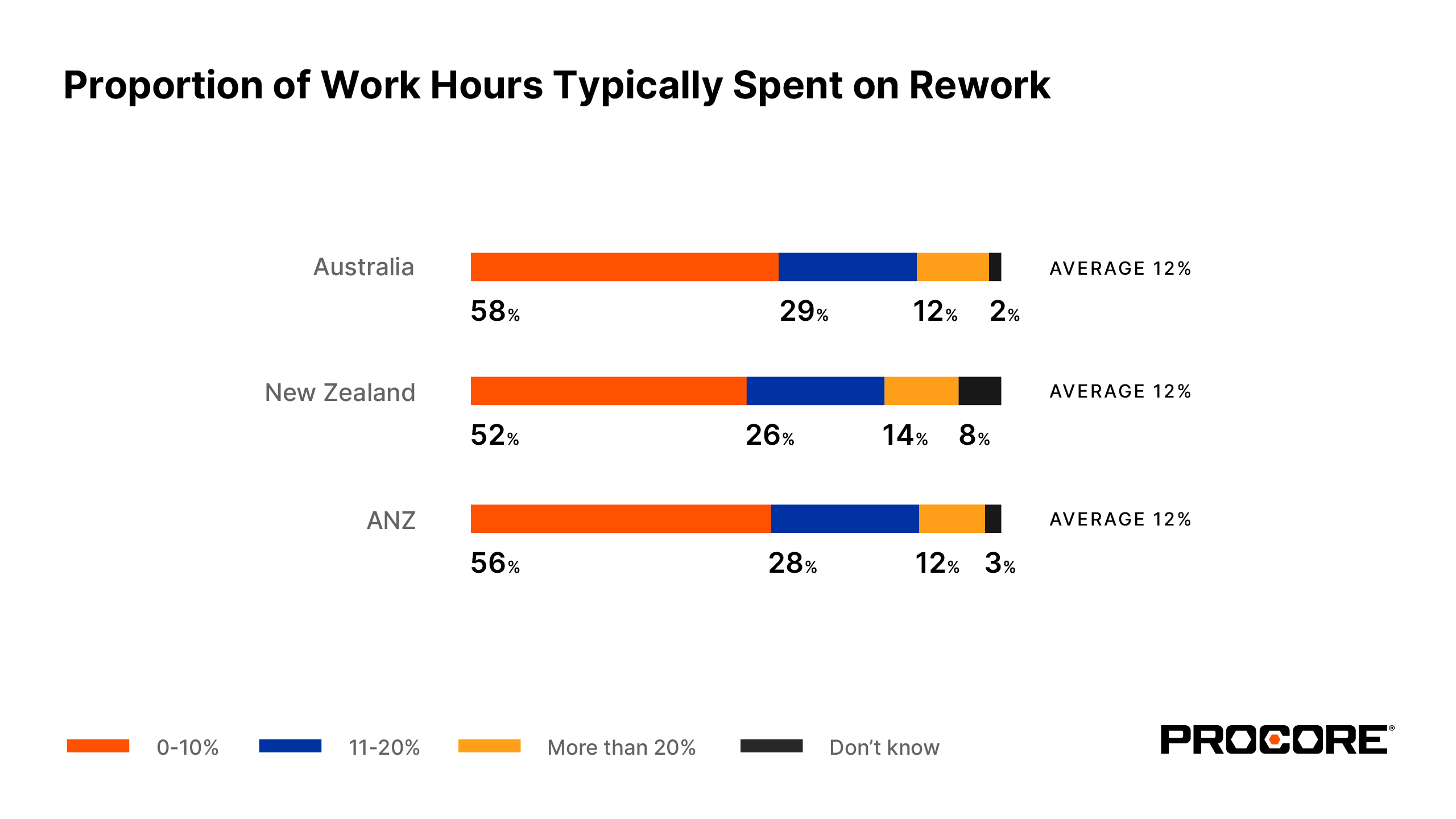

Rework benefits are maintained but improvements must be made: The focus on quality and safety, and the link to reducing rework is paying off for construction firms in Australia and New Zealand. While projects experienced a 12% uplift in reduced rework with this year's research participants across ANZ, 1 in 8 hours is still being spent on rework. Smaller-size firms proved to be leading the way with positive outcomes.

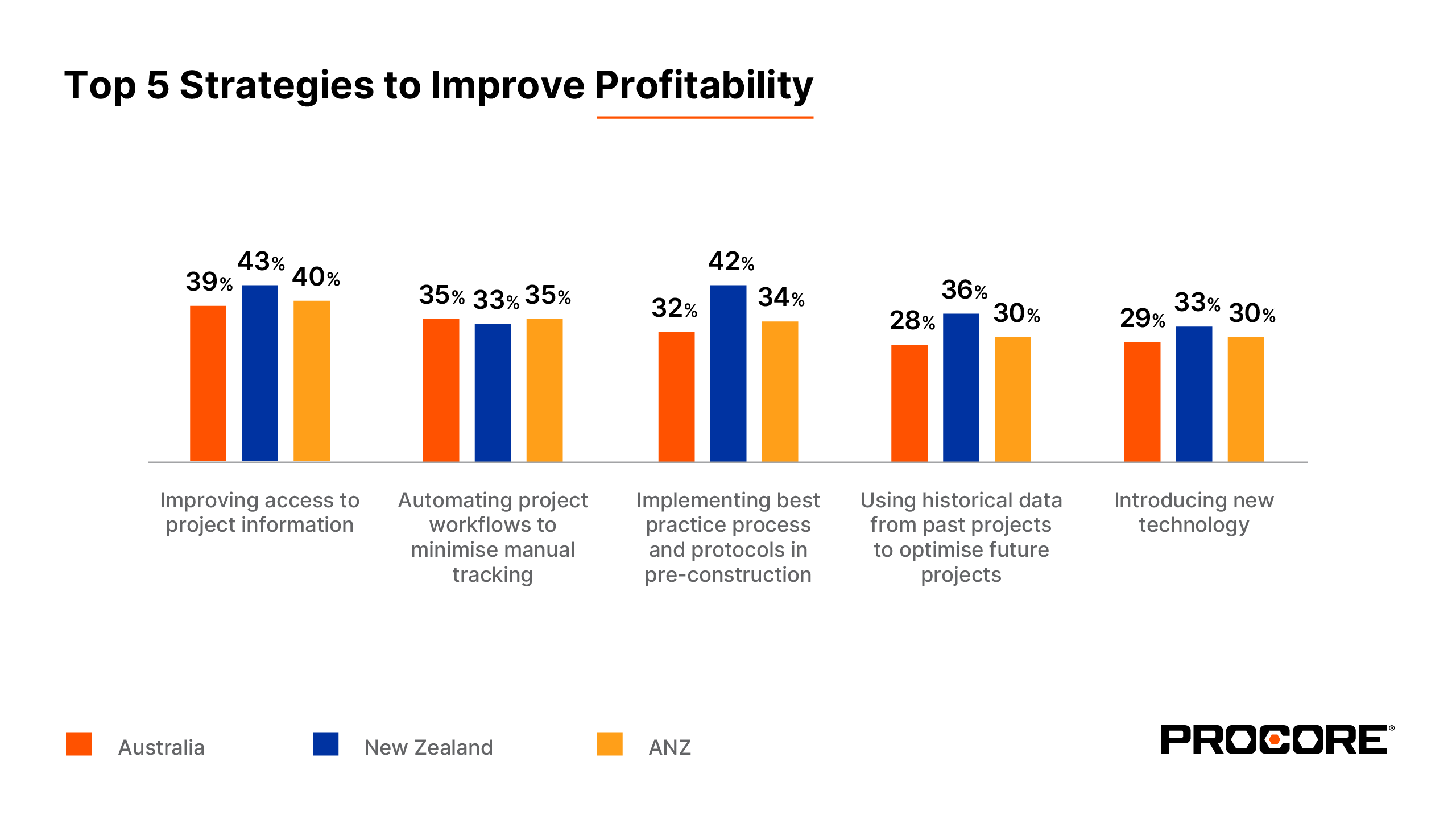

Industry participants are solving volatility, risk and cash pressures themselves: Costs, margin, productivity and payments are an interconnected suite of challenges that place extreme pressure on cash flow. Consequently, participants are writing contracts in new ways, swapping reduced margin for advance payments and secured cash flow. The risk of project insolvency is now a recognised industry-wide issue that impacts more than stand-alone projects.

The future is infrastructure – for some: The infrastructure space was acknowledged as providing the greatest opportunities for the construction industry. However, only one-third of firms believe they can successfully participate in infrastructure tenders and deliver on the project. It's no surprise larger firms (100+ employees) are more confident than firms with less than 100 employees – 17% more confident.

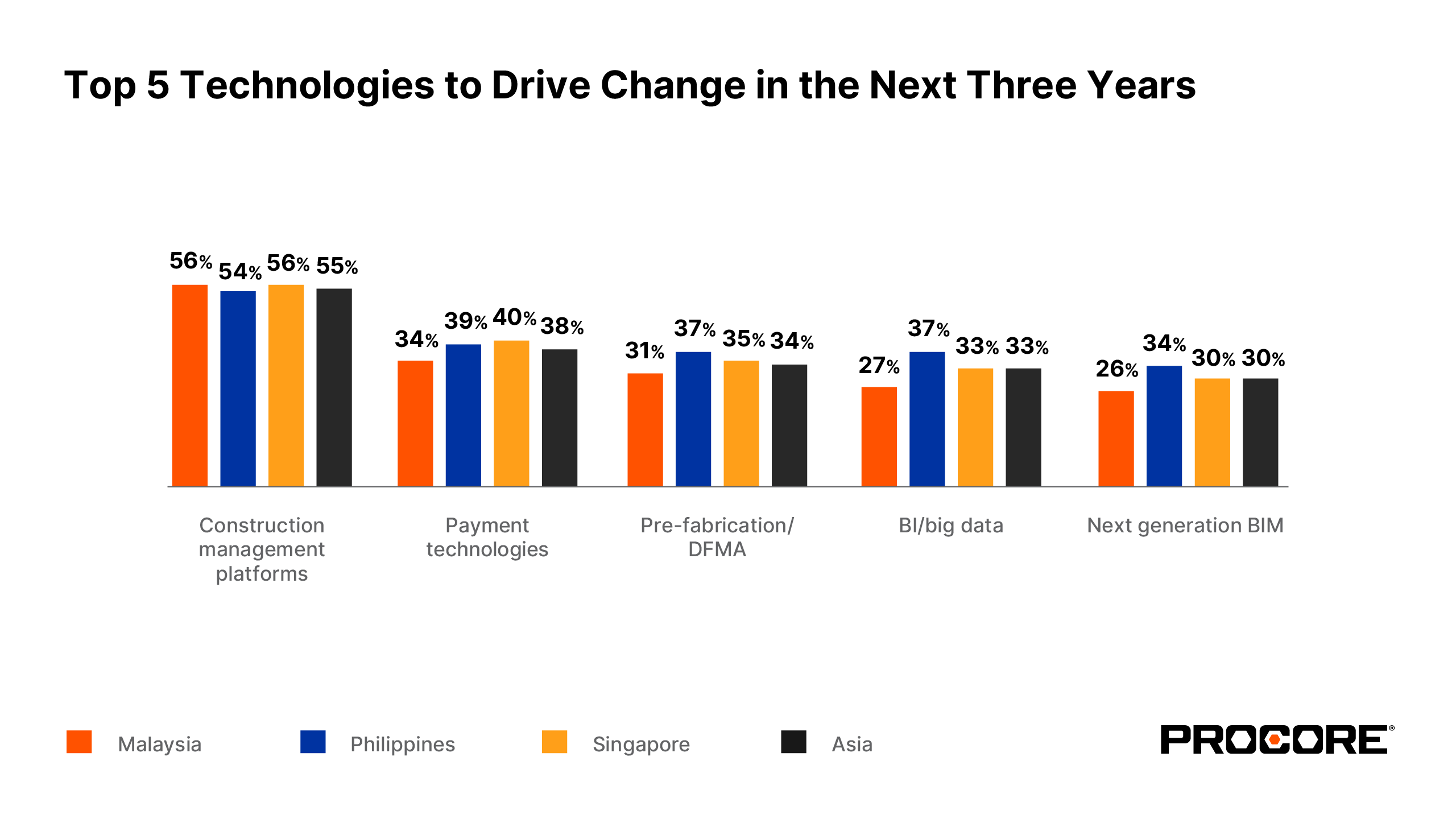

Data is everywhere: Half of ANZ construction businesses plan on designing a data strategy in the next 12 months; however, only 3 in 10 are very confident this will be successful. Senior decision-makers say that change management and data security are among the greatest threats. This is a pivot point for the leaders who champion the change. They need to recognise their role and responsibility for implementing those same technology solutions and programs to achieve greater productivity and profitability. Construction management software platforms grow in popularity: Around half of participants are currently using construction and payment technologies, which will lead to improved productivity and profitability.

Ongoing labour shortage: Just 3 in 10 (30%) businesses are very confident they have the necessary skills over the next 12 months to grow. An ongoing lack of skilled talent has driven a slightly weaker sentiment in Australia (4%), while New Zealand sentiment weakens by 8% when compared to last year.

The report also acknowledged the alignment of softening sentiment and weakening market conditions. Construction sector confidence has eased slightly in Australia, with projected strong sentiment for the next 12 months dropping by 5%. However, there is an almost 20% decline in projected confidence across New Zealand.

This led to an overall softening of expected success for construction firms in ANZ. Smaller size construction firms are anticipating a sharper softening in market conditions. This is borne out with fewer – around 10% - firms believing they will see an increase in the value of projects over the coming months for firms of any size.

“An interesting outcome of this research highlighted one central consideration. The construction sector will continue to have a fundamental problem with how it operates unless it capitalises on the opportunity to digitise its processes and business – effectively stopping the ripple effect of not knowing what is happening in real time. The costs to industry are now too significant for technology solutions and their benefits to be ignored,” Karemacher concluded.

Research for How We Build Now - Technology and Industry Trends Connecting ANZ Construction in 2023 was independently completed by research specialists YouGov. The fourth in an annual ‘benchmark series’, the research behind How We Build Now - Technology and Industry Trends Connecting ANZ Construction in 2023 was conducted by independent research company YouGov. The survey included five markets with a total of 1644 construction decision-makers and influencers participating in this report across Australia (592), Malaysia (303), New Zealand (176), Philippines (303) and Singapore (270). Download How We Build Now - Technology and Industry Trends Connecting ANZ Construction in 2023 here.

About Procore

Procore is a leading global provider of construction management software. Over one million projects and more than $1 trillion USD in construction volume have run on Procore's platform. Procore’s platform connects key project stakeholders to solutions Procore has built specifically for the construction industry—for the developer, the head contractor, and the subcontractor. Procore's App Marketplace has a multitude of partner solutions that integrate seamlessly with Procore’s platform, giving construction professionals the freedom to connect with what works best for them. Headquartered in Carpinteria, California, Procore has offices around the globe. Learn more at Procore.com.